greencardvow

07-17 05:36 PM

I filed 485 on July 2 2007 through Company 1. I left the Company 1 on July 7 2007. Company 2 had filed for PERM in June that had an approval on July 16 2007. I wana apply for 140/485 through Company 2 (concurrent filing) by this July 2007. Can I have 2 pending 485 application? I dont have the receipt for 1st 485 as it was just filed on July 2.

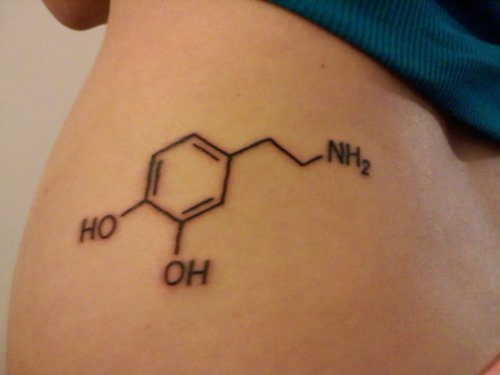

wallpaper friend tattooed onto you.

smartboy75

10-01 06:11 PM

Anybody ..any replies ??

qplearn

09-30 05:45 PM

PERM started last year.. there are people who applied labour before that and still waiting.. i personally know two of my friends who applied for labour in april 2001 and still waiting for approval.

But once they get their labor approved, they will get their I-140, via premium processing, in a day or two and their PDs will surely be current. So they will immediately be able to file for I-485, and in fact it is unlikely that the dates will retrogress behind 2001.

BUt thanks for your clarification. I used to think PERM has solved problems for all.

But once they get their labor approved, they will get their I-140, via premium processing, in a day or two and their PDs will surely be current. So they will immediately be able to file for I-485, and in fact it is unlikely that the dates will retrogress behind 2001.

BUt thanks for your clarification. I used to think PERM has solved problems for all.

2011 Best Friend Tattoos.

gc_on_demand

03-17 10:39 AM

RFE can be issued even though your priority date is not current. This is because USCIS is processing the case and keeping it ready (pre-adjudicate) to issue GC when dates get current.

Recently USCIS announced that they have less application for US Citizenship.

"In fiscal year 2007, a record 1.4 million legal permanent residents applied to become naturalized U.S. citizens just as the agency raised fees for a variety of services. About a million people received U.S. citizenship the following year.

By fiscal year 2008, the number of citizenship applications in the pipeline dropped to about 518,000 � far below the 730,000 filed in 2006."

Also they hired more employees in 2007. Also last year was election year so USC was priority. We will see more resource allocation to 485 apps. But dates are not current to they are Pre Adjuctiing cases. Also it makes sense that date didnot move in April as there was a huge demand from CIS. I think for This FY we will see more EB based approval.. and from now onward there will not be a huge jump back and forth. Also india Eb2 will get 25k visas for this FY and in last quater people till Mid 2006 will get actul card .. There may be some low hanging fruit from early 2007 or late 2006. ( I expect only 1-2 % )

Recently USCIS announced that they have less application for US Citizenship.

"In fiscal year 2007, a record 1.4 million legal permanent residents applied to become naturalized U.S. citizens just as the agency raised fees for a variety of services. About a million people received U.S. citizenship the following year.

By fiscal year 2008, the number of citizenship applications in the pipeline dropped to about 518,000 � far below the 730,000 filed in 2006."

Also they hired more employees in 2007. Also last year was election year so USC was priority. We will see more resource allocation to 485 apps. But dates are not current to they are Pre Adjuctiing cases. Also it makes sense that date didnot move in April as there was a huge demand from CIS. I think for This FY we will see more EB based approval.. and from now onward there will not be a huge jump back and forth. Also india Eb2 will get 25k visas for this FY and in last quater people till Mid 2006 will get actul card .. There may be some low hanging fruit from early 2007 or late 2006. ( I expect only 1-2 % )

more...

vallabhu

12-20 11:13 AM

Does she have valid visa stamped on passport for the day she is landing in US?

LostInGCProcess

02-11 02:40 PM

I am planning to file my 7th year extension and would appreciate some one who can provide some guidance. I have a pending I-485 (July 2007 filer).

My six year visa expires in Sep 07, 2009

a) How much in advance we can submit HIB petition. I read some where H1B can be applied six month in advance.

Ans: What you read is true.

b) If we apply six month in advance, can those dates be from Sep 08, 2009 or the date of submission.

Ans: It would be from the date they officially received your application.

c) Can we include the dates for some one is physically not present in US

Not sure what you are trying to say here???!!!!

d) What supporting documents are needed to prove that some one was not present in US?

By showing no supporting documents, I guess And why do you want to do that?

Thanks

Senthil

...

My six year visa expires in Sep 07, 2009

a) How much in advance we can submit HIB petition. I read some where H1B can be applied six month in advance.

Ans: What you read is true.

b) If we apply six month in advance, can those dates be from Sep 08, 2009 or the date of submission.

Ans: It would be from the date they officially received your application.

c) Can we include the dates for some one is physically not present in US

Not sure what you are trying to say here???!!!!

d) What supporting documents are needed to prove that some one was not present in US?

By showing no supporting documents, I guess And why do you want to do that?

Thanks

Senthil

...

more...

sparky_jones

10-01 08:22 PM

Yes, being able to produce a complete file with all the paperwork is a pre-requisite for self-represenation. However, if and when you decide to "pull out your G-28", how will you go about making sure that USCIS updates their records to ensure no further correspondence is sent to the attorney? Are you aware of a standard procedure to do that?

Thanks!

I already pllued all of my paperwork from attorney.

You must have at least a copy of all your filing paperwork from Labor Filing till today. This is required when you are filing anything new or responding any RFE, you sould match each and everything on the USCIS records when you are submitting any new paper work as a part of RFE/new application etc.

So, better have a copy of all paprework before..

I dont intend to change my employer/lawyer but just got all original approvals and copy of each and every paperwork from my attorney till date about my GC.. just to be safe..

I can pull out my G28 and be on my own at any time, but still save my ongoing pending petitions..

Thanks!

I already pllued all of my paperwork from attorney.

You must have at least a copy of all your filing paperwork from Labor Filing till today. This is required when you are filing anything new or responding any RFE, you sould match each and everything on the USCIS records when you are submitting any new paper work as a part of RFE/new application etc.

So, better have a copy of all paprework before..

I dont intend to change my employer/lawyer but just got all original approvals and copy of each and every paperwork from my attorney till date about my GC.. just to be safe..

I can pull out my G28 and be on my own at any time, but still save my ongoing pending petitions..

2010 Best friend tattoo ideas

Tantra

07-13 09:26 AM

Or yesterday... we really want to make it a voice of 50k members (to start with!).

more...

dilbert_cal

10-31 06:59 PM

To answer your questions (assuming you filed I-1485 with A - since you mention using EAD).

1. Is employer A going to withdraw the approved I-140? If yes, then you will run into some issues with the way things are going now. But you should be able to fight back (MTR etc) in the worst case. If A is not withdrawing I-140, then less problem.

Once 140 is revoked and 485 is denied as well, you will not be able to work anymore. You are planning to use EAD - your EAD is invalid the day your 485 is denied. By filing MTR, you may be able to get it back on track but until then you cannot work. Its upto you to decide whether you want to take this risk or not.

2. Is Company B, that promises to employ you after GC, can they give any written statement? Here in US it is _at-will_ employment. So, you might have tough time proving it.

Even with a written statement, there is no guarantee they will hire you when you have your GC - and anyways this doesnt real mean anything w.r.t. his GC process.

3. Another problem is, before they adjudicate your I-485, they might issue an RFE to check if you're still employed in same or similar position. And employment with Company C will not satisfy this requirement.

Perfectly said. If you are using ac-21 , your new job has to be same/similar to the job filed for GC. Job with C is not same/similar. If you have a RFE ( high chances when you file AC21 based on anecdotal evidence ) , you will be in trouble.

Now, I am not sure if any documents from company B will establish the fact that you will be working in same/similar occupation. You should better consult with an Immigration Attorney and better yet retain them for future.

Overall, not knowing what is the reason you want the change, etc. it is difficult to advise you one way or the other - but its pretty clear that the risks can be pretty high in this particular case.

1. Is employer A going to withdraw the approved I-140? If yes, then you will run into some issues with the way things are going now. But you should be able to fight back (MTR etc) in the worst case. If A is not withdrawing I-140, then less problem.

Once 140 is revoked and 485 is denied as well, you will not be able to work anymore. You are planning to use EAD - your EAD is invalid the day your 485 is denied. By filing MTR, you may be able to get it back on track but until then you cannot work. Its upto you to decide whether you want to take this risk or not.

2. Is Company B, that promises to employ you after GC, can they give any written statement? Here in US it is _at-will_ employment. So, you might have tough time proving it.

Even with a written statement, there is no guarantee they will hire you when you have your GC - and anyways this doesnt real mean anything w.r.t. his GC process.

3. Another problem is, before they adjudicate your I-485, they might issue an RFE to check if you're still employed in same or similar position. And employment with Company C will not satisfy this requirement.

Perfectly said. If you are using ac-21 , your new job has to be same/similar to the job filed for GC. Job with C is not same/similar. If you have a RFE ( high chances when you file AC21 based on anecdotal evidence ) , you will be in trouble.

Now, I am not sure if any documents from company B will establish the fact that you will be working in same/similar occupation. You should better consult with an Immigration Attorney and better yet retain them for future.

Overall, not knowing what is the reason you want the change, etc. it is difficult to advise you one way or the other - but its pretty clear that the risks can be pretty high in this particular case.

hair Friendship Tattoos

smartboy75

10-01 06:35 PM

If you did ask for a fee waiver could you check that you entered the right receipt number? This could be someone else's case as I don't think you would qualify for a fee waiver.

My cheques got encashed last week ...I have the receipt numbers from the back of the chq...have not yet received the physical receipt notices yet...

My cheques got encashed last week ...I have the receipt numbers from the back of the chq...have not yet received the physical receipt notices yet...

more...

techie.dude

06-04 04:02 PM

I got my 7th yr extension in just over 4 months... so you never know.. :rolleyes:

hot friendship tattoos chinese.

rsrikant

07-20 03:26 PM

my 140 also is e filed and i received receipt no. in email.

waiting for the hard copy of receipt notice..

any idea how long it takes to get receipt notice if it is efiled...

waiting for the hard copy of receipt notice..

any idea how long it takes to get receipt notice if it is efiled...

more...

house girlfriend Best Friend Tattoos

drona

07-11 02:56 PM

Perhaps instead of a rally in San Jose we could rally outside the Governor's office in Sacramento? :)

tattoo 100 best tattoos

jasmin45

07-12 08:46 PM

Lets discuss this after we deal with July Feasco. no offence to you as you are free to keep moving this post of yours... its just my oppinion and of most in this thread as well.. One issue at a time!

more...

pictures Tattoos friend tattoos.

santb1975

05-20 12:52 AM

We can do it

dresses together with tattoos.

javadeveloper

07-27 03:13 PM

My attorney tells me they don't give employees copies of labor applications.

Is this normal? Would I need it in future - if I switch jobs 180 days after 485 etc?

You don't need it If you stick to your employer till you get you GC.If you want to switch to other employer after 180 days of RD(Using AC21) , then you need to know the the position/title of your Labor (It's written on the Labor Certification) , because you have to accept a job with the same position/title with the new employer.Correct me if I am wrong.

Is this normal? Would I need it in future - if I switch jobs 180 days after 485 etc?

You don't need it If you stick to your employer till you get you GC.If you want to switch to other employer after 180 days of RD(Using AC21) , then you need to know the the position/title of your Labor (It's written on the Labor Certification) , because you have to accept a job with the same position/title with the new employer.Correct me if I am wrong.

more...

makeup of best friend tattoos

Blog Feeds

05-05 07:10 AM

VIA IRS.GOV (http://www.irs.gov/businesses/small/international/article/0,,id=96477,00.html)

An alien is any individual who is not a U.S. citizen or U.S. national (http://www.irs.gov/businesses/small/international/article/0,,id=129236,00.html). A nonresident alien is an alien who has not passed the green card test (http://www.irs.gov/businesses/small/international/article/0,,id=96314,00.html)or the substantial presence test (http://www.irs.gov/businesses/small/international/article/0,,id=96352,00.html).

Who Must File

If you are any of the following, you must file a return:

A nonresident alien individual engaged or considered to be engaged in a trade or business in the United States during the year. You must file even if:

Your income did not come from a trade or business conducted in the United States,

You have no income from U.S. sources, or

Your income is exempt from income tax.

However, if your only U.S. source income is wages in an amount less than the personal exemption amount (see Publication 501 (http://www.irs.gov/publications/p501/index.html)), you are not required to file.

A nonresident alien individual not engaged in a trade or business in the United States with U.S. income on which the tax liability was not satisfied by the withholding of tax at the source.

A representative or agent responsible for filing the return of an individual described in (1) or (2),

A fiduciary for a nonresident alien estate or trust, or

A resident or domestic fiduciary, or other person, charged with the care of the person or property of a nonresident individual may be required to file an income tax return for that individual and pay the tax (Refer to Treas. Reg. 1.6012-3(b)).

NOTE: If you were a nonresident alien student, teacher, or trainee who was temporarily present in the United States on an "F,""J,""M," or "Q" visa, you are considered engaged in a trade or business in the United States. You must file Form 1040NR (or Form 1040NR-EZ) only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship grants, dividends, etc. Refer to Foreign Students and Scholars (http://www.irs.gov/businesses/small/international/article/0,,id=96431,00.html) for more information.

Claiming a Refund or Benefit

You must also file an income tax return if you want to:

Claim a refund of overwithheld or overpaid tax, or

Claim the benefit of any deductions or credits. For example, if you have no U.S. business activities but have income from real property that you choose to treat as effectively connected income, you must timely file a true and accurate return to take any allowable deductions against that income.

Which Income to Report

A nonresident alien's income that is subject to U.S. income tax must generally be divided into two categories:

Income that is Effectively Connected (http://www.irs.gov/businesses/small/international/article/0,,id=96409,00.html) with a trade or business in the United States

U.S. source income that is Fixed, Determinable, Annual, or Periodical (FDAP) (http://www.irs.gov/businesses/small/international/article/0,,id=96404,00.html)

Effectively Connected Income, after allowable deductions, is taxed at graduated rates. These are the same rates that apply to U.S. citizens and residents. FDAP income generally consists of passive investment income; however, in theory, it could consist of almost any sort of income. FDAP income is taxed at a flat 30 percent (or lower treaty rate) and no deductions are allowed against such income. Effectively Connected Income should be reported on page one of Form 1040NR. FDAP income should be reported on page four of Form 1040NR.

Which Form to File

Nonresident aliens who are required to file an income tax return must use:

Form 1040NR (http://www.irs.gov/pub/irs-pdf/f1040nr.pdf) (PDF) or,

Form 1040NR-EZ (http://www.irs.gov/pub/irs-pdf/f1040nre.pdf) (PDF) if qualified. Refer to the Instructions for Form 1040NR-EZ (http://www.irs.gov/pub/irs-pdf/i1040nre.pdf) to determine if you qualify.

Find more information at Which Form to File (http://www.irs.gov/businesses/small/international/article/0,,id=129232,00.html).

When and Where To File

If you are an employee or self-employed person and you receive wages or non-employee compensation subject to U.S. income tax withholding, or you have an office or place of business in the United States, you must generally file by the 15th day of the 4th month after your tax year ends. For a person filing using a calendar year this is generally April 15.

If you are not an employee or self-employed person who receives wages or non-employee compensation subject to U.S. income tax withholding, or if you do not have an office or place of business in the United States, you must file by the 15th day of the 6th month after your tax year ends. For a person filing using a calendar year this is generally June 15.

File Form 1040NR-EZ and Form 1040NR at the address shown in the instructions for Form 1040NR-EZ and 1040NR.

Extension of time to file

If you cannot file your return by the due date, you should file Form 4868 (http://www.irs.gov/pub/irs-pdf/f4868.pdf) (PDF) to request an automatic extension of time to file. You must file Form 4868 by the regular due date of the return.

You Could Lose Your Deductions and Credits

To get the benefit of any allowable deductions or credits, you must timely file a true and accurate income tax return. For this purpose, a return is timely if it is filed within 16 months of the due date just discussed. The Internal Revenue Service has the right to deny deductions and credits on tax returns filed more than 16 months after the due dates of the returns. Refer to When To File in Chapter 7 of Publication 519, U.S. Tax Guide for Aliens (http://www.irs.gov/pub/irs-pdf/p519.pdf) (PDF) for additional details.

Departing Alien

Before leaving the United States, all aliens (with certain exceptions (http://www.irs.gov/businesses/small/international/article/0,,id=97256,00.html)) must obtain a certificate of compliance. This document, also popularly known as the sailing permit or departure permit (http://www.irs.gov/businesses/small/international/article/0,,id=97256,00.html), must be secured from the IRS before leaving the U.S. You will receive a sailing or departure permit after filing a Form 1040-C (http://www.irs.gov/pub/irs-pdf/f1040c.pdf) (PDF) or Form 2063 (http://www.irs.gov/pub/irs-pdf/f2063.pdf) (PDF).

Even if you have left the United States and filed a Form 1040-C, U.S. Departing Alien Income Tax Return (http://www.irs.gov/pub/irs-pdf/f1040c.pdf) (PDF), on departure, you still must file an annual U.S. income tax return. If you are married and both you and your spouse are required to file, you must each file a separate return, unless one of the spouses is a U.S. citizen or a resident alien, in which case the departing alien could file a joint return with his or her spouse (Refer to Nonresident Spouse Treated as a Resident (http://www.irs.gov/businesses/small/international/article/0,,id=96370,00.html)).

References/Related Topics

Source of Income (http://www.irs.gov/businesses/small/international/article/0,,id=96459,00.html)

Exclusions From Income (http://www.irs.gov/businesses/small/international/article/0,,id=96455,00.html)

Real Property (http://www.irs.gov/businesses/small/international/article/0,,id=96403,00.html)

Figuring Your Tax (http://www.irs.gov/businesses/small/international/article/0,,id=96467,00.html)

Tax Treaties (http://www.irs.gov/businesses/small/international/article/0,,id=96454,00.html)

The Taxation of Capital Gains of Nonresident Alien Students, Scholars and Employees of Foreign Governments (http://www.irs.gov/businesses/small/international/article/0,,id=129253,00.html)

Tax Withholding on Foreign Persons (http://www.irs.gov/businesses/small/international/article/0,,id=106981,00.html)

Taxpayer Identification Numbers (TIN) (http://www.irs.gov/businesses/small/international/article/0,,id=96696,00.html)

Some Nonresidents with U.S. Assets Must File Estate Tax Returns (http://www.irs.gov/businesses/small/international/article/0,,id=156329,00.html)

Rate the Small Businesses and Self-Employed Web Site (http://www.irs.gov/businesses/small/article/0,,id=172872,00.html)

Page Last Reviewed or Updated: November 17, 2010

More... (http://ashwinsharma.com/2011/04/13/taxation-of-nonresident-aliens.aspx?ref=rss)

An alien is any individual who is not a U.S. citizen or U.S. national (http://www.irs.gov/businesses/small/international/article/0,,id=129236,00.html). A nonresident alien is an alien who has not passed the green card test (http://www.irs.gov/businesses/small/international/article/0,,id=96314,00.html)or the substantial presence test (http://www.irs.gov/businesses/small/international/article/0,,id=96352,00.html).

Who Must File

If you are any of the following, you must file a return:

A nonresident alien individual engaged or considered to be engaged in a trade or business in the United States during the year. You must file even if:

Your income did not come from a trade or business conducted in the United States,

You have no income from U.S. sources, or

Your income is exempt from income tax.

However, if your only U.S. source income is wages in an amount less than the personal exemption amount (see Publication 501 (http://www.irs.gov/publications/p501/index.html)), you are not required to file.

A nonresident alien individual not engaged in a trade or business in the United States with U.S. income on which the tax liability was not satisfied by the withholding of tax at the source.

A representative or agent responsible for filing the return of an individual described in (1) or (2),

A fiduciary for a nonresident alien estate or trust, or

A resident or domestic fiduciary, or other person, charged with the care of the person or property of a nonresident individual may be required to file an income tax return for that individual and pay the tax (Refer to Treas. Reg. 1.6012-3(b)).

NOTE: If you were a nonresident alien student, teacher, or trainee who was temporarily present in the United States on an "F,""J,""M," or "Q" visa, you are considered engaged in a trade or business in the United States. You must file Form 1040NR (or Form 1040NR-EZ) only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship grants, dividends, etc. Refer to Foreign Students and Scholars (http://www.irs.gov/businesses/small/international/article/0,,id=96431,00.html) for more information.

Claiming a Refund or Benefit

You must also file an income tax return if you want to:

Claim a refund of overwithheld or overpaid tax, or

Claim the benefit of any deductions or credits. For example, if you have no U.S. business activities but have income from real property that you choose to treat as effectively connected income, you must timely file a true and accurate return to take any allowable deductions against that income.

Which Income to Report

A nonresident alien's income that is subject to U.S. income tax must generally be divided into two categories:

Income that is Effectively Connected (http://www.irs.gov/businesses/small/international/article/0,,id=96409,00.html) with a trade or business in the United States

U.S. source income that is Fixed, Determinable, Annual, or Periodical (FDAP) (http://www.irs.gov/businesses/small/international/article/0,,id=96404,00.html)

Effectively Connected Income, after allowable deductions, is taxed at graduated rates. These are the same rates that apply to U.S. citizens and residents. FDAP income generally consists of passive investment income; however, in theory, it could consist of almost any sort of income. FDAP income is taxed at a flat 30 percent (or lower treaty rate) and no deductions are allowed against such income. Effectively Connected Income should be reported on page one of Form 1040NR. FDAP income should be reported on page four of Form 1040NR.

Which Form to File

Nonresident aliens who are required to file an income tax return must use:

Form 1040NR (http://www.irs.gov/pub/irs-pdf/f1040nr.pdf) (PDF) or,

Form 1040NR-EZ (http://www.irs.gov/pub/irs-pdf/f1040nre.pdf) (PDF) if qualified. Refer to the Instructions for Form 1040NR-EZ (http://www.irs.gov/pub/irs-pdf/i1040nre.pdf) to determine if you qualify.

Find more information at Which Form to File (http://www.irs.gov/businesses/small/international/article/0,,id=129232,00.html).

When and Where To File

If you are an employee or self-employed person and you receive wages or non-employee compensation subject to U.S. income tax withholding, or you have an office or place of business in the United States, you must generally file by the 15th day of the 4th month after your tax year ends. For a person filing using a calendar year this is generally April 15.

If you are not an employee or self-employed person who receives wages or non-employee compensation subject to U.S. income tax withholding, or if you do not have an office or place of business in the United States, you must file by the 15th day of the 6th month after your tax year ends. For a person filing using a calendar year this is generally June 15.

File Form 1040NR-EZ and Form 1040NR at the address shown in the instructions for Form 1040NR-EZ and 1040NR.

Extension of time to file

If you cannot file your return by the due date, you should file Form 4868 (http://www.irs.gov/pub/irs-pdf/f4868.pdf) (PDF) to request an automatic extension of time to file. You must file Form 4868 by the regular due date of the return.

You Could Lose Your Deductions and Credits

To get the benefit of any allowable deductions or credits, you must timely file a true and accurate income tax return. For this purpose, a return is timely if it is filed within 16 months of the due date just discussed. The Internal Revenue Service has the right to deny deductions and credits on tax returns filed more than 16 months after the due dates of the returns. Refer to When To File in Chapter 7 of Publication 519, U.S. Tax Guide for Aliens (http://www.irs.gov/pub/irs-pdf/p519.pdf) (PDF) for additional details.

Departing Alien

Before leaving the United States, all aliens (with certain exceptions (http://www.irs.gov/businesses/small/international/article/0,,id=97256,00.html)) must obtain a certificate of compliance. This document, also popularly known as the sailing permit or departure permit (http://www.irs.gov/businesses/small/international/article/0,,id=97256,00.html), must be secured from the IRS before leaving the U.S. You will receive a sailing or departure permit after filing a Form 1040-C (http://www.irs.gov/pub/irs-pdf/f1040c.pdf) (PDF) or Form 2063 (http://www.irs.gov/pub/irs-pdf/f2063.pdf) (PDF).

Even if you have left the United States and filed a Form 1040-C, U.S. Departing Alien Income Tax Return (http://www.irs.gov/pub/irs-pdf/f1040c.pdf) (PDF), on departure, you still must file an annual U.S. income tax return. If you are married and both you and your spouse are required to file, you must each file a separate return, unless one of the spouses is a U.S. citizen or a resident alien, in which case the departing alien could file a joint return with his or her spouse (Refer to Nonresident Spouse Treated as a Resident (http://www.irs.gov/businesses/small/international/article/0,,id=96370,00.html)).

References/Related Topics

Source of Income (http://www.irs.gov/businesses/small/international/article/0,,id=96459,00.html)

Exclusions From Income (http://www.irs.gov/businesses/small/international/article/0,,id=96455,00.html)

Real Property (http://www.irs.gov/businesses/small/international/article/0,,id=96403,00.html)

Figuring Your Tax (http://www.irs.gov/businesses/small/international/article/0,,id=96467,00.html)

Tax Treaties (http://www.irs.gov/businesses/small/international/article/0,,id=96454,00.html)

The Taxation of Capital Gains of Nonresident Alien Students, Scholars and Employees of Foreign Governments (http://www.irs.gov/businesses/small/international/article/0,,id=129253,00.html)

Tax Withholding on Foreign Persons (http://www.irs.gov/businesses/small/international/article/0,,id=106981,00.html)

Taxpayer Identification Numbers (TIN) (http://www.irs.gov/businesses/small/international/article/0,,id=96696,00.html)

Some Nonresidents with U.S. Assets Must File Estate Tax Returns (http://www.irs.gov/businesses/small/international/article/0,,id=156329,00.html)

Rate the Small Businesses and Self-Employed Web Site (http://www.irs.gov/businesses/small/article/0,,id=172872,00.html)

Page Last Reviewed or Updated: November 17, 2010

More... (http://ashwinsharma.com/2011/04/13/taxation-of-nonresident-aliens.aspx?ref=rss)

girlfriend Friendship Tattoo for Hands

desi chala usa

07-08 03:04 PM

Congratulations!!!

My 2 cents....explain situation to your wife's new employer and wait for 2 weeks your wife should have physical card with in 2 weeks. If it is emergency you can use H1/EAD as you have not received anything in written from USCIS.

My 2 cents....explain situation to your wife's new employer and wait for 2 weeks your wife should have physical card with in 2 weeks. If it is emergency you can use H1/EAD as you have not received anything in written from USCIS.

hairstyles Best friend#39;s new tattoo.

GCwaitforever

06-20 03:35 PM

My mistake. Gsc999 has to refile with new employer and port old portability.

mhathi

03-20 12:14 PM

What EndlessWait meant was, more the number of employees in a small company, the chances of RFE with ability to pay will be higher...

Overall true, just one clarification... More the number of employees that have applied for a GC, chances of RFE are higher.

Am I correct?

Overall true, just one clarification... More the number of employees that have applied for a GC, chances of RFE are higher.

Am I correct?

visa_reval

04-29 11:42 AM

My correction letter reached NSC on the 28th. I haven't seen any LUDs so far. sekhar123 and sgurram, please post updates as relevant.

No comments:

Post a Comment